Of course, in the face of the "marketing spree" of solid-state batteries on the market, the power battery leader Ningde era can not sit still.

In April, Wu Kai, chief scientist of Ningde Times, disclosed that Ningde Times has the opportunity to produce solid-state batteries in small batches in 2027. He said that if the maturity of all-solid-state batteries is expressed by the number 1-9, the current maturity of the Ningde era is at the level of 4, and the goal is to reach the level of 7-8 by 2027.

The "change of mouth" of Ningde era is more like an illustration of the industry atmosphere. At present, the entire battery industry has entered the stage of solid-state battery "carnival", as a battery leader if there is no dynamic, is bound to lead to investors and the market that the company in the field of innovation behind the industry misunderstanding.

In fact, as early as 2023 during the Shanghai Auto Show, Ningde Times has released condensed matter batteries, its single energy density up to 500Wh/kg, and the first application of the battery scene is the aviation field.

Taking into account that Ningde era has a research and development team of more than 20,000 people, the research and development investment in 2023 is as high as 18.3 billion yuan, and the advantage of R&D innovation in next-generation batteries such as solid-state batteries is stronger than most companies.

In general, the greatest significance of semi-solid state batteries is the breakthrough of 0-1, whether it is the direct development of all-solid state, or to meet the current needs of the transition products to evolve, its ultimate purpose is high energy, high safety all-solid-state batteries.

Semi-solid battery and all-solid battery is not a word difference, the current semi-solid battery technology system actually has very large interoperability with the liquid battery production process, including the diaphragm is not removed, the most intuitive change is the electrolyte replacement for semi-solid electrolyte.

If you only look at the changes in experience, the main highlights of semi-solid batteries are safety and battery life.

The all-solid-state battery has higher requirements for lithium battery materials, production process, and packaging methods, and the chemical properties have changed greatly, and the existing liquid battery production process is more different, and the technical system needs to be re-established, including the supply network and market ecology.

From the industry chain point of view, the current domestic mainstream enterprises have successively joined the solid state battery system research and development process, including the development of solid electrolyte replacement electrolyte and diaphragm, but because the current solid electrolyte specific technical route has not been determined, so the demand for specific metal elements are also different; The positive electrode material continues to use the high nickel ternary, and changes to the rich lithium manganese base; The negative electrode material gradually evolves to the direction of silicon based negative electrode and lithium metal negative electrode. At the same time, due to the impact of packaging methods, it is expected to drive the demand for aluminum-plastic film......

The development trend of domestic solid-state batteries is strong, and the layout of technological research and industrialization is also improving. According to incomplete statistics of the battery network, in just five months since 2024, there have been more than ten solid-state battery projects in China, and the total investment amount has been nearly 40 billion yuan.

In addition, as of now, 14 domestic enterprises related to the field of solid-state battery manufacturing have obtained 48 rounds of financing. Specifically, Qingtao Energy received 10 rounds of financing, Weilan New Energy received 8 rounds of financing, Huineng Technology received 7 rounds of financing, Xinjie Energy received 6 rounds of financing, Tailan New Energy received 5 rounds of financing, High Energy Times, Ganfeng lithium Power, Enli Power received 2 rounds of financing, leading New Energy, Zhongke Shenlan Huize, Zhonggu Times, Zhongke Fixed Energy, Ronggu New Materials, Yihua New Energy received 1 round of financing.

During this year‘s two sessions, solid-state battery technology triggered extensive discussion and proposals. Among them, Chen Jun, academician of the Chinese Academy of Sciences and vice president of Nankai University, said in an interview that solid-state batteries are the focus of research and development in various countries, and once industrialization, it will change the pattern of the electric vehicle industry and open up emerging markets such as electric aviation.

Chen Jun introduced that his team actively undertakes major national research and development plans, key research and development projects, and works with Beijing‘s scientific and technological innovation advantage units to tackle key problems, and has developed a 400Wh/kg solid-state battery, which is more than 30% compared with the most advanced 300Wh/kg lithium electronic battery energy density on the market. The next one to two years to break through 600Wh/kg solid state battery research and development.

In addition, in the past two years, China has made significant progress in solid-state battery patent applications and layout, and even surpassed Japan in patent layout.

As of May 27, from the perspective of technical sources (patent applicants), Japan is still the world‘s largest country in the field of solid-state battery patent applications, accounting for nearly 40% of the global patent applications, China ranked second, accounting for about 26.6%. However, from the perspective of the layout market (where patent applications are located), China is the world‘s largest market for solid-state battery patent layout, accounting for about 31.4%. Japan followed with about 27 percent.

EVTank analysis said that overseas enterprises represented by Japan and the United States laid out solid-state batteries earlier, including Toyota, Panasonic, Solid Power, QuantumScape, etc., with all-solid-state batteries as the development goal, and its industrialization progress is relatively slow. Chinese enterprises represented by Weilan New Energy, Qingtao Energy and Ganfeng Lithium Power have chosen semi-solid batteries with easier industrialization as transition stage products, promoting the industrialization of semi-solid batteries.

It is understood that Japan and South Korea are mainly based on sulfide systems, and China is mostly based on oxides and sulfide systems, while start-up companies in the United States have a layout in sulfides, oxides and polymers.

Yu Qingjiao, secretary-general of the Zhongguancun new battery Technology Innovation Alliance, said that at present, the polymer, oxide and sulfide routes are relatively mature compared with other routes, and there are more enterprises in the layout. Among them, the advantage of polymer is easy to process, the cost also has a certain advantage, but the conductivity and stability is poor; The conductivity and stability of oxides are relatively good, but the cost is higher than that of polymers. Sulfide has excellent conductivity, but poor thermal stability, difficult process and high cost.

In addition to technical difficulties, the biggest problem facing solid-state batteries is the difficulty of mass production, including issues involving high material costs and complex manufacturing processes. According to the current progress announced by domestic battery manufacturers and car companies, the mass production time of all-solid-state batteries is mainly concentrated in 2026-2028, and it is expected to achieve industrialization in 2030; Foreign battery companies such as Japan and South Korea are also focused on mass production from 2027 to 2030.

Among them, 2027 is a key node, who will be the first to land applications, or will change the future market pattern to a certain extent.

However, under the dual limitations of technology and cost, the industrialization of all-solid-state batteries is a long way to go.

Conclusion:

Since this year, the solid state battery industry chain has been frequently good news, semi-solid state batteries have been installed in succession, car companies have also released related solid-state battery new products or road test operation....... In addition, with the rapid development of the eVTOL industry, it puts forward higher requirements for battery energy density, safety, and rate performance, but the current battery technology can not fully meet its requirements, so the future solid-state batteries are expected to usher in batch applications in eVTOL.

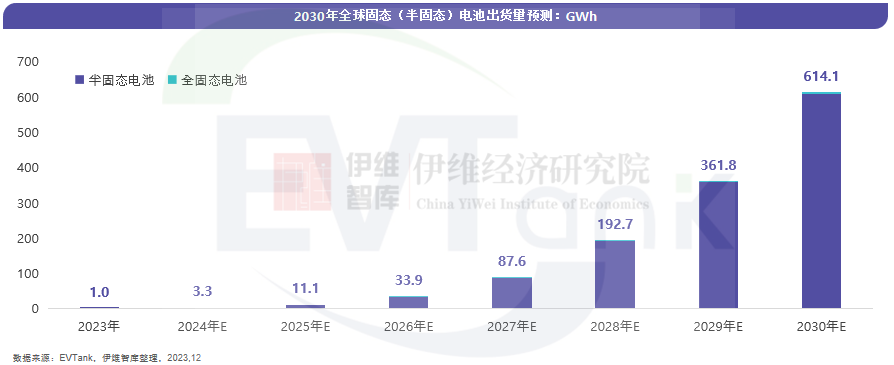

Based on the research and judgment of the solid-state battery technology route and cost reduction path, EVTank expects that by 2030, the global shipments of solid-state batteries will reach 614.1GWh, the penetration rate of the overall lithium battery is expected to be about 10%, and the market size will exceed 250 billion yuan, mainly for semi-solid-state batteries.

Source: Battery 100 People - Battery

network author: Chang Qing